The Building Black Wealth NOW newsletter will appear periodically before each stop on NAREBŌĆÖs historic nationwide Building Black Wealth tour. Over the next 24 months, NAREB, with its partners, the National Bar Association and the African American Mayors Association, will hold events in Black communities to provide critical information to Black consumers about how to accumulate wealth. Buy homes. Invest in properties. Properly handle property after the passing of loved ones. These are just a few of the subject areas to be discussed during these festive events that include activities for youths. Improving Black wealth is essential for overcoming the daily bias at home, school, work, and play.┬ĀIt is the only way our communities can progress.┬ĀThe second stop on the tour is Saturday, November 11, from 10 a.m. to 3 p.m. at the┬ĀStar Church, 7400 London Avenue, Birmingham, Alabama. Come out and learn how to gain wealth and overcome the barriers we continue to face in America.┬ĀPlease encourage your family, friends, and colleagues to attend.┬ĀOur newsletter will bring you stories that will enlighten our communities about the history of our struggles and highlight the many who have succeeded and how gaining wealth has been crucial to their success.┬ĀLearn the path they took, the obstacles they overcame, and how you can do the same.–┬ĀA message from┬ĀNAREB President Dr. Courtney Johnson Rose |

NAREB’s Black Wealth Tour Stops in Birmingham on Saturday, 11/11/23, with a Free Community Wealth Building Day for Families & IndividualsFree workshops, youth activities, housing counselors, one-on-one sessions, and more at festivities designed to help Black families┬Ābuild intergenerational wealthThe National Association of Real Estate Brokers (NAREB) will hold its Birmingham Black Wealth Tour Event on Saturday, November 11, starting at 10 a.m. at The Star Church, 7400 London Avenue.┬ĀThe event, including festive youth activities, will help empower the cityŌĆÖs Black communities with steps towards homeownership, property investment, business, and other wealth-building opportunities.Working with Mayor Randall L. Woodfin, who will speak at the event, and local lawyers with the National Bar Association, the event┬Āwill include classes, workshops, and one-on-one counseling on homebuying, investing, credit, and careers in real estate.┬ĀThe goal of the event is to give Black residents the information they need to build wealth and get answers to questions like how to buy a home. How do you deal with property after the death of a loved one? How to improve your credit score?ŌĆ£The NAREB Black Wealth Tour events are helping Black families recognize and embark on paths towards gaining wealth,ŌĆØ said Marcus Brown, a NAREB board member from Birmingham.┬ĀŌĆ£We are urging families to attend so they can learn more about how to position themselves to become homeowners and gain wealth.ŌĆØ┬Ā┬ĀREAD MORE |

|

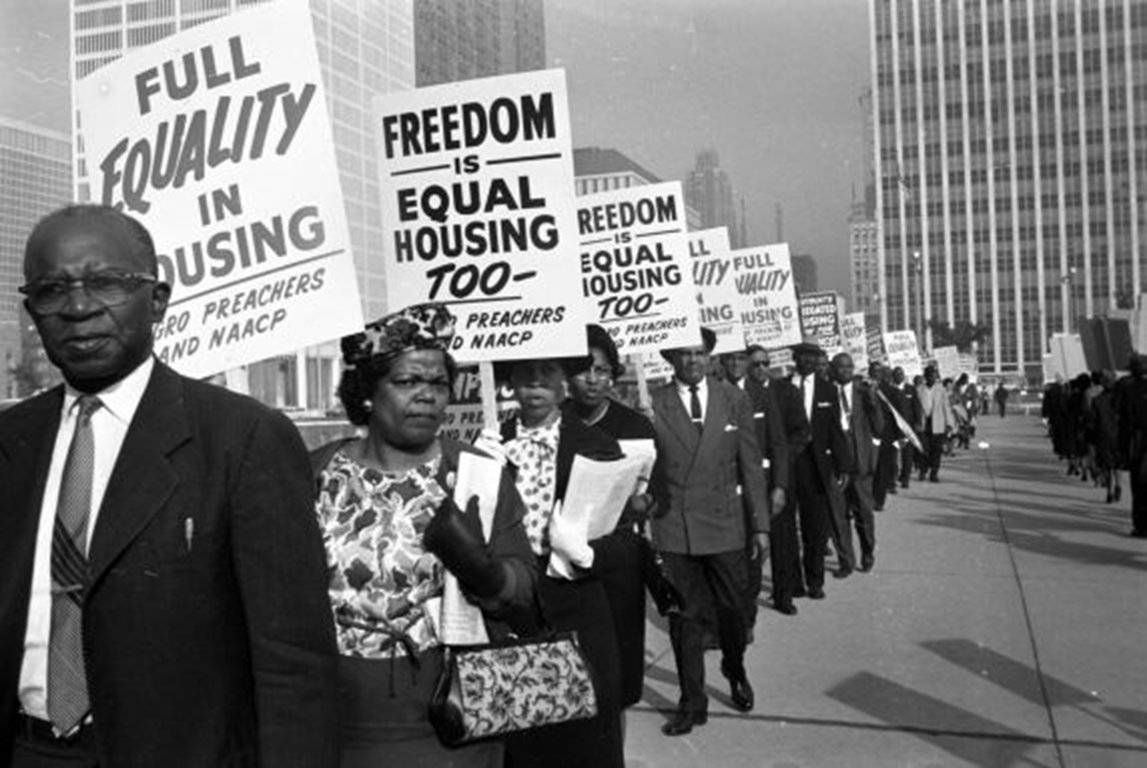

The Black-White Wealth Gap: Created Over Decades by Discriminatory Real Estate Practices and Biased Public Policies |

|

Protesters Challenge the Biased Housing Practices and Policies in the mid-20th Century.The racial wealth gap across the United States is stunning.┬ĀThe National Association of Real Estate Brokers (NAREB) has determined that the Black-White wealth gap is so expansive in the United States that the 400 wealthiest Americans control the same amount of wealth as the 48 million Blacks living in the country.The median wealth for White households is $188,200, compared to $24,100 for Black families and $36,100 for Hispanic households.WhatŌĆÖs so discouraging is despite all the talk about equity, equality, and a ŌĆśReckoning on RaceŌĆÖ during the protests after the murder of George Floyd, the wealth gap remains vast, with Blacks unable to significantly move the needle in a positive direction.One reason for the substantial wealth gap is the starkly different homeownership rates for Blacks and Whites.┬ĀIn 2022, the rate of homeownership among White people was 74.4%, and for Blacks, it was 45%., a gap of 24.9 %. In 1990, before Civil Rights legislation and the Fair Housing Act, which made housing discrimination illegal, there was a 27-point spread between Black and White homeownership.┬ĀSo, in 63 years, Black home ownership has not significantly improved.What frequently is missed is that homeownership is a driver of wealth, especially for Blacks. The equity from owning a home can be used to start a business, pay for a college education, and have a comfortable retirement. It is the centerpiece of family economic security.The seeds for the disparity in wealth grew from racist public policies and private practices in the middle of the 20th┬Ācentury.┬ĀREAD MORE |

Robert Butler’s Strong Commitment to Empower Black Communities and Bolster Homeownershipand Black Wealth in Birmingham, Alabama |

|

In the bustling real estate landscape of Birmingham, Alabama, Robert Butler stands out.┬ĀA seasoned real estate [professional, Butler has an unwavering commitment to his clients and a relentless pursuit of knowledge and innovation in the industry. He represents a unique blend of expertise, dedication, and community engagements.As he leverages cutting-edge technology and marketing techniques to provide maximum benefits for his clients, Butler, 75, is committed to ensuring that families and individuals that he represents receive the most current information and strategies for success in the ever-evolving real estate market.ŌĆ£The real joy I got was when I finally convinced somebody to buy a house, and they got to the closing table and the excitement that they had on the closing day, and the joy that they seemed to experience whether it was their first home or an upgraded home or just a better home,ŌĆØ he said. ŌĆ£I know many agents get to the closing and look forward to the commission at the end of the sale. That is important, too, but that was not the most important thing for me.┬ĀIt was seeing the joy of seeing the buyer get the home they had worked so hard for.ŌĆØButler’s work as an assistant and store manager and at Church’s Chicken served as a poignant reminder of the remarkable distance he traveled in a series of jobs, working for other people.┬ĀAt 24, after his parents purchased a home, Butler set a goal that he and his wife would rent for a few years after they married while saving money to buy a home.┬ĀThat was 53 years ago. ŌĆ£I had set a goal,ŌĆØ he recalls. ŌĆ£I knew my parents had finally bought a house we’d rented for a long time. And, so my goal after I got married was that I would rent for maybe the first five years, and then we would buy a house and try to upgrade every five years after that.ŌĆØREAD MORE |

TO READ THE ENTIRE BLACK WEALTH NOW! NEWSLETTER CLICK┬ĀHERE |

|

NAREB WANTS EVERY FAMILY TO ENJOY THE AMERICAN DREAM OF HOMEOWNERSHIP |

ABOUT THE NATIONAL ASSOCIATION OF REAL ESTATE BROKERSNAREB was formed in 1947 to secure equal housing opportunities regardless of race, creed, or color. NAREB has advocated for legislation and supported or instigated legal challenges that ensure fair housing, sustainable homeownership, and access to credit for Black Americans. Simultaneously, NAREB advocates for and promotes access to business opportunities for Black real estate professionals in each real estate discipline.┬Ā┬ĀFrom the past to the present, NAREB remains an association proud of its history, dedicated to its chosen struggle, and unrelenting in its pursuit of the REALTIST┬«ŌĆÖs mission/vision embedded goal, ŌĆ£Democracy in Housing.ŌĆØ |